- #Monthly expenses chart how to

- #Monthly expenses chart plus

- #Monthly expenses chart professional

- #Monthly expenses chart download

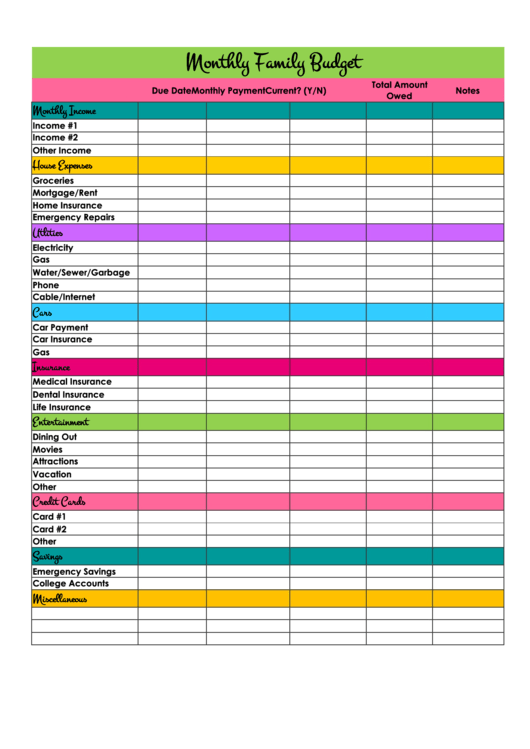

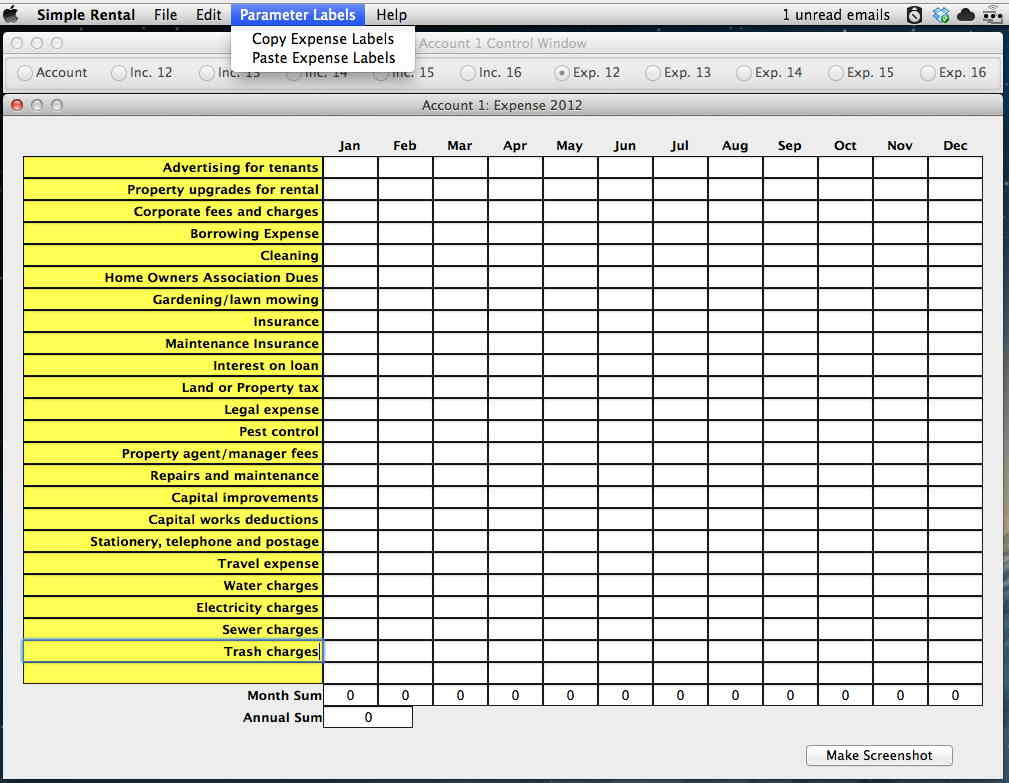

With a tab for each month and a year-to-date summary, you can watch your financial progress throughout the whole year. 20 Common Monthly Expenses to Include in Your Budget. You learn that once you are retired, you will have to pay $350 per month ($4,200 per year) for this coverage. Move the graph to the same sheet as the expenses graph and format it the same as we did for the pie graph (points 3 to 5). This is going to be a monthly budget which will then be turned into a chart.

#Monthly expenses chart how to

Step 1: How to determine and enter your income. Overall the maximum money spent was in the year 2010 and then in 2000. However, if you add an additional payment every month of $500 from your discretionary income, you'll cut your mortgage term in half and have your house paid off in 15 years. View Budget Pie Graph.xlsx from MATH 123-52D at Ivy Tech Community College, Indianapolis. In the budget tracking chart, the totals are compared to your budget so. Then divide this number by 12 to get your monthly income.

#Monthly expenses chart plus

Click the plus sign in the lower left corner of your Google Sheet to add a tab. And in order to create an accurate pie chart, you need to know how much money you're spending each month. Some bills are monthly and some come less often. With a personal budget template, budget management is so easy. Use the information from your monthly budget to create a visual representation of how you spend your money.

#Monthly expenses chart download

Download a free sample Microsoft Excel budget template. If you are maintaining a budget for business expenses, this sheet can make end of year tax preparation smooth and easy. Household budget: Build a family budget with the kids. Check out the selection of the best Monthly Planners designed to keep you well organized, productive, and upbeat person, achieving all your goals successfully. The first step is to write down all of your recurring bills in the first tab of the free monthly budget calculator.

It includes an array of categories and subcategories, so you can set it up exactly.

#Monthly expenses chart professional

In my professional experience, a family's average monthly household expenses include the following costs: Auto /Transportation. Double click the new tab to rename it "Pie Chart.". From the mobile app: Open the app and select Monthly from the bottom menu. Using monthly budget sheets helps make it easier. Of course, depending on your lifestyle and preferences, you may wish to tweak this original expense listing to suit your needs. It is useful for understanding how each item is changing. Forecasting: year-to-date monthly variance with end of year forecast. The Monthly Expense Chart Template for Excel Online is a highly functional and reliable template that you can use to log your daily expenses and group them according to categories. Then type in those categories and percentages to the Canva tool. By taking a closer look at your budget, you can gain better control over your finances. #14 for nailing the key fact and being able to handle overspending. Every day when you get home, write down anything you've spent.

Have the basic numbers? Now figure out how much your ideal lifestyle costs It's less than you think.

0 kommentar(er)

0 kommentar(er)